While the Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the U.S. tax system, many of the changes were only made on a temporary basis. Several critical provisions are scheduled to expire after 2025, absent congressional action. With strategic planning, you can reduce the impact on your finances.

The Lifetime Exclusion and Estate Taxes

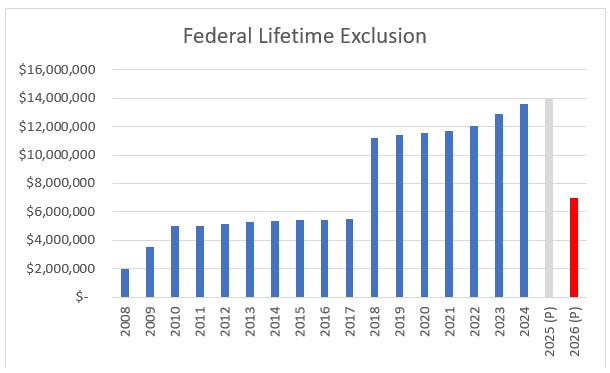

The federal estate and gift tax rate reaches 40% after the lifetime gift/estate tax exclusion is applied. The TCJA doubled the lifetime exclusion to $10 million, with annual adjustments for inflation. The exclusion amount in 2024 is $13.61 million ($27.22 million for married couples filing jointly), increasing to $13.99 million ($27.98 million for married couples jointly) in 2025.

The lifetime exclusion represents the combined amount of taxable gift transfers that an individual can make during their lifetime and at death without owing gift or estate tax. While that individual is alive, the lifetime exclusion is reduced by the taxable gifts that individual makes. For example, if an individual who dies in 2024 had made $1 million in taxable gifts during their lifetime, that individual’s lifetime exclusion would have been reduced to $12.61 million at death, thereby allowing the estate of that individual to make taxable transfers of up to $12.61 million without owing any Federal estate tax.

Gifting is an effective strategy to take advantage of the current high level of lifetime exclusion. Individuals acting before December 31, 2025, can use gifts to move approximately $14 million out of their estate. This amount will decrease to approximately $7 million in 2026 in the absence of an act of Congress.

Gifting to trusts can often be most beneficial for a number of reasons, including:

- Allowing control to remain with the trustee to avoid young or spendthrift beneficiaries from receiving assets outright;

- Use of the Generation Transfer Tax (GST) exemption amount; and

- The possibility of allowing the donor to continue to pay the income taxes on the trust, assets which allows the trust to grow tax-free outside of the estate.

If you are not comfortable losing access to the assets, consider gifting to a Spousal Lifetime Access Trust (SLAT). A SLAT allows you to include your spouse as a beneficiary of the trust but still remove the trust for both the donor’s and the spouse’s estates. To learn more about how a SLAT works, please review our article at https://www.orba.com/spousal-lifetime-access-trust/.

The IRS issued regulations to make clear that post-2025 estates of individuals that took advantage of the increased lifetime exclusion amount from 2018 through 2025, will not be adversely impacted when the lifetime exclusion drops. In other words, assuming that the lifetime exclusion drops to approximately $7 million in 2026, the IRS will not seek to tax those gifts made between 2018 and 2025 that were in excess of that amount.

Annual Gifts

The annual gift tax exclusion allows an individual to make a certain amount of otherwise taxable gifts annually without these gifts reducing that individual’s lifetime exclusion. For 2024, the annual gift tax exclusion is $18,000 per donee (or $36,000 per donee for married couples that elect to split their gifts on a timely filed gift tax return). This amount increases to $19,000 per done in 2025. This annual gift tax exclusion is per donee, which means an individual can make annual gifts of present interests up to this amount to an unlimited amount of donees without incurring taxes or consuming any portion of that individual’s lifetime exclusion, while simultaneously reducing that individual’s estate. The reduction can be significant. For example, if an individual were to make gifts to 10 separate individuals of $36,000 this year and were to elect to split these gifts with their spouse, these gifts would reduce the taxable estate of that individual by $360,000 without consuming any portion of that individual’s lifetime exclusion.

You can get even more bang for your gifting buck by super funding gifts to a Sec. 529 educational savings plan. Earnings in a 529 plan are tax deferred and can be withdrawn free of tax if used for qualified education expenses. Qualified education expenses include tuition and fees, books, room and board, and to a limited extent, student loan payments. You are permitted to accelerate five years of annual exclusion gifts to these educational savings accounts in a single year. For instance, in 2024 alone, you could give up to $90,000 (or $180,000 for a married couple that elects to split gifts) per 529 account (i.e., $18,000 annual exclusion x 5 years = $90,000).

Act Now

Additional tax-planning strategies are available to help you leverage favorable TCJA provisions while they last. Do not delay your planning, though — CPAs, attorneys, appraisers and other experts will have their calendars full as the expiration date draws near and more taxpayers scramble to adjust to the potentially changed landscape.

For more information, contact your ORBA advisor at 312.670.7444.

Related Services

Related Industries

Dental

Health Care

Law Firms and Lawyers

Manufacturing and Distribution

Not-For-Profit

Real Estate

Restaurant

Sports & Entertainment