IRS Ruling Final Regulations 2024-14542 includes final guidance on Required Minimum Distributions (RMDs), inherited retirement accounts and other items. This Client Alert is a high-level overview of certain provisions and changes. This does not cover all provisions included in the 260 page final regulations, found here.

These regulations generally apply to distributions made on or after January 1, 2025. There are waivers from 2021-2024; there is no penalty and no requirement to take the prior distribution. It may still be more beneficial for some individuals to take the distributions to spread the amount over multiple years in hopes to reduce associated taxes.

Important Definitions:

5-Year Rule Only

All remaining amounts in the account are distributed by the end of the 5th year after death, with no yearly distribution requirement.

10-Year Rule Only

All remaining amounts in the account are distributed by the end of the 10th year after death, with no yearly distribution requirement.

Beneficiary

Person assigned either by direct election, law or trust to receive assets from another person.

Designated Beneficiary

Person directly named as beneficiary through more than one method.

Eligible Designated Beneficiary

A surviving spouse, child under 21, disabled or chronically ill individual or another individual who is not more than ten years younger than the employee. Also, some see-through trusts benefiting those just described.

Joint and Last Survivor Table

Table used to calculate RMDs for a participant whose spouse is their sole primary beneficiary and who is more than 10 years younger than the participant.

Life Expectancy

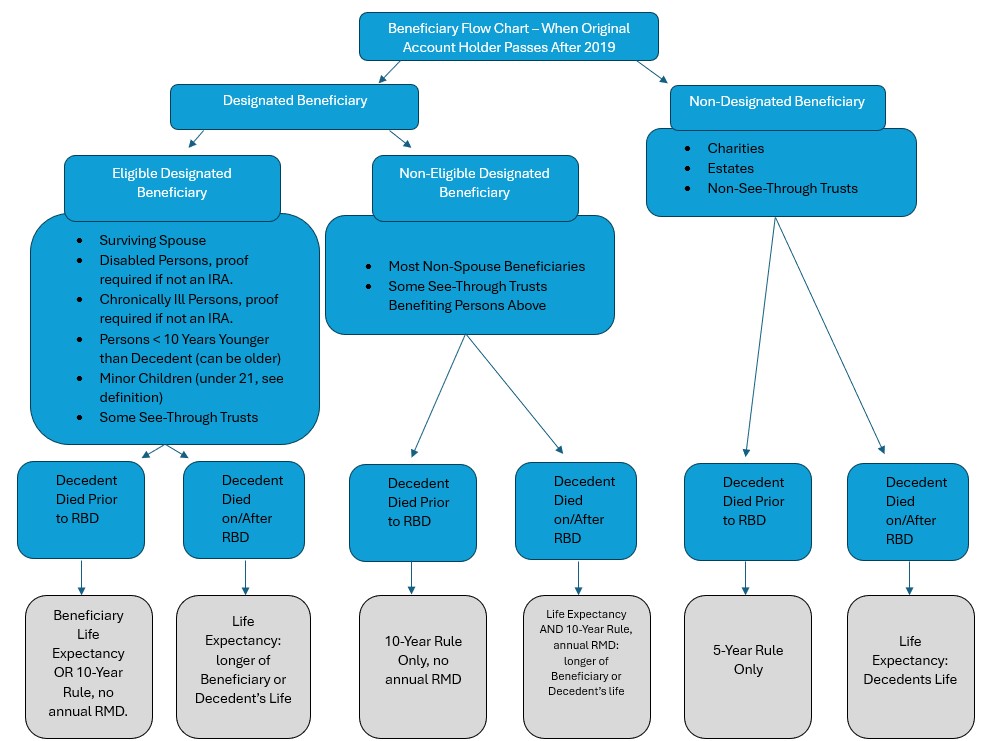

Annual RMDs with no 5- or 10-year entire balance payout requirement. The distributions are provided over the life expectancy of the beneficiary, the decedent or the longer of the two depending on the type of beneficiary and if whether the death of the employee occurred before or after the RBD. See chart below.

Life Expectancy or 10-Year rule

The preference between these two can be chosen. This choice may be limited by the plan and can have different rules for different beneficiaries.

Life Expectancy and 10-Year rule

Life expectancy-based RMDs must be taken in years 1–9 after the year of death, with all remaining amounts in the account distributed by the end of the 10th year after death.

Minor Children (under 21)

Regardless of whether the decedent dies before or after the RMD, once the minor reaches age 21, the 1o-year rule applies and RMDs are mandatory.

Non-Eligible Designated Beneficiary

Most non-spouse beneficiaries and some see-through trusts benefitting those just described.

Non-Designated Beneficiary

Charities, estates and non-see-through trusts.

Required Beginning Date (RBD)

April 1 of the year following the year you reach your applicable age. This April 1 date is the deadline by which your RMD from your own retirement account must be taken. This was age 72 in 2022 and is age 73 from 2023 until 2031.

Required Minimum Distribution (RMD)

The minimum amount you must take out of your retirement account after a certain age to avoid a tax penalty.

See-Through Trust

A trust set up solely for retirement accounts. There are 4 requirements to qualify as a see-through trust:

- The trust must be valid under state law.

- The trust must be irrevocable or become irrevocable upon the death of the account holder.

- All the trust’s underlying Beneficiaries must be identifiable as being eligible to be Designated Beneficiaries themselves.

- A copy of the trust must be provided to the custodian by October 31 the following year after the account holder’s death.

If the trust is considered a see-through trust, determining whether it is a conduit or accumulation trust (depending on whether retirement account proceeds are required to be distributed immediately to the beneficiaries or allowed to accumulate within the trust) can ultimately determine whether the life expectancy or 10-year rule applies to distributions to the trust and its beneficiaries.

Single Life Expectancy Table

This table determines the life expectancy that a beneficiary must use to calculate annual RMDs for their inherited accounts.

Successor Beneficiary

A beneficiary who inherits a retirement account from the primary (original) beneficiary.

Uniform Lifetime Table

The life expectancy used to calculate RMDs for participants. This table assumes the participant’s beneficiary is 10 years younger than the participant, regardless of the beneficiary’s age.

Top factors that affect these determinations:

- Whether the date of death of the original account holder occurred before or after SECURE Act changes;

- The type of beneficiary: eligible designated, non-eligible designated, or non-designated;

- Whether or not the original account holder had reached their required beginning date upon their death.

Common Provisions:

- If a participant dies before the Required Beginning Date (RBD) and the designated beneficiary is not an eligible designated beneficiary, the beneficiary must empty the account by the end of the 10th year after the year of the participant’s death with no annual distribution requirement.

- If a participant dies after the RBD and the designated beneficiary is not an eligible designated beneficiary, the beneficiary must continue to take annual RMDs, with the entire benefit distribution by the end of the tenth year after the year of the participant’s death.

- Even though there are waivers until 2025, the 10-year clock still starts on the original account holder’s death, even if that was in 2020-2024.

- If the decedent did not take the RMD in the year of death, and a beneficiary missed the year of death RMD, they now have until 12/31 following year of death to take it without penalty.

- Plans can choose to keep the required beginning date of 70.5. They are not required to increase on the sliding scale based on date of birth.

- A plan can require eligible designated beneficiaries to use either the lifetime expectancy rule or the 10-year rule, rather than choosing between the two. There can also be different rules for different beneficiaries.

- If an employee’s entire interest is in a designated Roth account, no lifetime distributions are required. Thus, upon the employee’s death, that employee is treated as having died before their RBD. When determining the account balance subject to the RMD rules, amounts held in a designated Roth account are disregarded. Under the proposed regulations, distributions from designated Roth accounts would not count toward satisfying any RMD but could be rolled over to a Roth IRA if they otherwise qualified as eligible rollover distributions.

Important provisions that are less common:

- If there is more than one beneficiary, the year of death RMD can be satisfied by any beneficiary as long it meets the minimum dollar requirement (rather than by every beneficiary). There are special rules if different IRA accounts have different beneficiaries due to required IRA aggregation.

- The notice filled in rules around the SECURE Act’s new provision allowing surviving spouses of retirement account owners to elect to be treated as the decedent for RMD purposes. The treatment for surviving spouses will not be identical to the decedents, since the surviving spouse must still calculate RMDs based on their own life expectancy, and none of their own beneficiaries will qualify as eligible designated beneficiaries.

- Successor beneficiary rules: if the original beneficiary was using life expectancy distributions (which could be because they inherited before the SECURE Act’s effective date or because they were an eligible designated beneficiary), the successor beneficiary will become subject to the 10-year rule. If the original beneficiary was subject to the 10-year rule, then the successor beneficiary will finish out the original beneficiary’s 10-year period.

- Also maintained is the obligation for ongoing annual distributions for a period of up to ten years following attainment of the age of majority by an eligible designated beneficiary who was a minor child of the employee receiving life expectancy payments.

- The hypothetical RMD rule: to the extent a surviving spouse initially uses the 10-year rule and later decides that they would like to treat the deceased spouse’s IRA as their own (or complete a spousal rollover), they will first need to ‘make up’ any RMDs they would have needed to have taken, had the funds hypothetically been in their IRA all along.

- Multiple designated minor beneficiaries: if an employee has more than one child as eligible designated beneficiaries, a full distribution is not required until ten years after the youngest of the employee’s children who are eligible designated beneficiaries attains the age of majority (or, if earlier, ten years after the last of those minor children dies).

- When a see-through trust is divided into separate trusts for each beneficiary upon the death of the retirement account owner, the RMD rules will be applied individually for each trust beneficiary rather than uniformly across all beneficiaries based on the beneficiary with the shortest required distribution timeline.

- When a retirement account (including IRAs) owns both annuity and non-annuity assets, those assets can be aggregated together for the purposes of calculating the participant’s RMD and that payments from the annuity can count against the total RMD for both annuity and non-annuity assets.

- Documentation of a disability or chronic illness must be provided to the plan administrator no later than October 31 of the calendar year following the calendar year of the employee’s death.

- There are special rules for successor beneficiaries, trust beneficiaries and annuities that are not covered here.

The IRS also recently released 36 pages of additional proposed regulations relating to retirement accounts. A public hearing on these is scheduled for September 25th. More information will be provided as it is released. (2024-14542, 2024)

For more information, contact Heather Smelley at [email protected] or 312.670.7444 or your ORBA advisor.

References

(2024, July 19). 2024-14542. Federal Register. Retrieved from federalregister.gov: https://www.federalregister.gov/documents/2024/07/19/2024-14542/required-minimum-distributions

Related Services

Related Industries

Dental

Health Care

Law Firms and Lawyers

Manufacturing and Distribution

Not-For-Profit

Real Estate

Restaurant

Sports & Entertainment